Sweet Leaf: The Untold Story

March 26, 2020 | (4 minute read)

As the cannabis industry in the U.S. developed over the last decade, all participants knew that significant federal intervention could end what so many had worked so hard to achieve. In that context, the 27-month long Sweet Leaf case was the single most dangerous event for the industry to date. The case became public on December 14, 2017 when the Denver police and city and state cannabis regulators raided all twelve of Sweet Leaf’s facilities in the city, arresting a number of budtenders and summarily suspending their cannabis licenses.

Denver Excise & Licensing accused one of the top-5 providers of cannabis to the U.S. market with operating a criminal enterprise by looping sales to customers. Regardless of its compliance with the state’s sales limit rule, the business owners generated windfall profits by diverting marijuana after the point of sale to surrounding non-legal states. The market price for the marijuana in those locations were three to five times the retail price in Denver.

March 26, 2020 | (4 minute read)

As the cannabis industry in the U.S. developed over the last decade, all participants knew that significant federal intervention could end what so many had worked so hard to achieve. In that context, the 27-month long Sweet Leaf case was the single most dangerous event for the industry to date. The case became public on December 14, 2017 when the Denver police and city and state cannabis regulators raided all twelve of Sweet Leaf’s facilities in the city, arresting a number of budtenders and summarily suspending their cannabis licenses.

Denver Excise & Licensing accused one of the top-5 providers of cannabis to the U.S. market with operating a criminal enterprise by looping sales to customers. Regardless of its compliance with the state’s sales limit rule, the business owners generated windfall profits by diverting marijuana after the point of sale to surrounding non-legal states. The market price for the marijuana in those locations were three to five times the retail price in Denver.

Investigation

Given that the administrative and criminal prosecution of the case would hinge on the scope and aggregate impact of Sweet Leaf’s activities and business practices, the specialized Data Analysis Unit (DAU) at the Marijuana Enforcement Division (MED) became instrumentally involved. By the end of the grand jury investigation, the DAU had identified $10 million in medical marijuana that was sold to loopers, transaction by transaction, in just ten months. One EPC* looper spent more than $575,000 in the span of 137 days (¶ 120).

Scale and Patterns

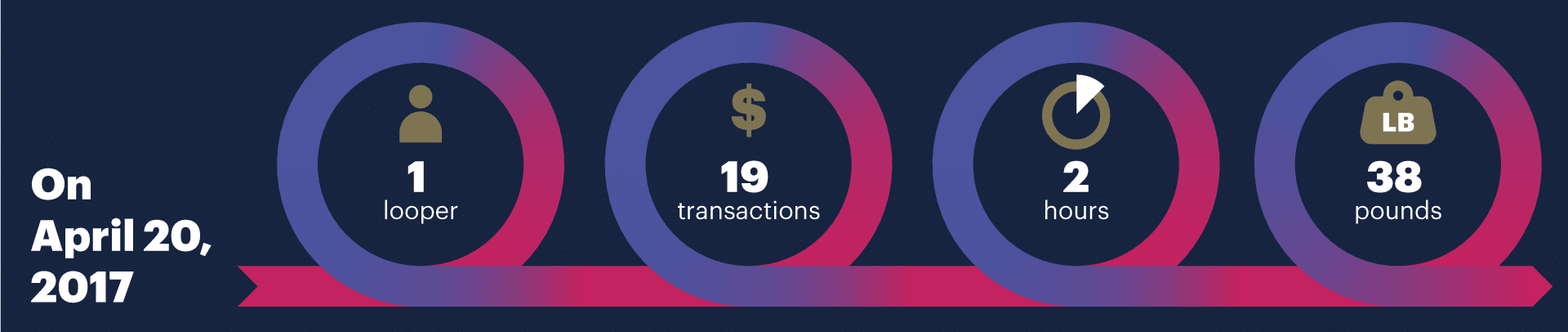

The largest single-day looper by weight managed to purchase over thirty-eight pounds in nineteen transactions in two hours on April 20, 2017–the busiest day of the year for Colorado stores. At their retail locations, the purchase pattern of out-of-state customers purchasing one ounce of flower was overwhelming (¶ 121-122). Testifying in the city’s license revocation hearing, one Sweet Leaf manager estimated that between thirty and fifty percent of Sweet Leaf’s $60-80 million in sales were to loopers (¶ 91).

Reaction

The undertones of the industry’s reaction made it appear that the Sweet Leaf case was significant enough to become a catalyst for federal intervention. In September 2018 the U.S. Attorney for Colorado went on record stating that his office was investigating a state-licensed business, confirming everyone’s worst fears. In the end, the combined weight of city and state regulators, plus the specter of federal prosecution, was sufficient to compel the owners to accept a plea bargain that included one year prison sentences. Despite the owners of Sweet Leaf doing hard time, the industry narrowly avoided a potentially devastating federal organized crime case from being prosecuted against a celebrated state-licensed cannabis business.

Costs

The cost imposed on the industry was the rescission of the Cole Memo. Just three weeks after news about Sweet Leaf broke, then-Attorney General Jeff Sessions took the opportunity to rescind the memo that seemingly protected the industry from federal intervention provided businesses remained compliant with state licensing regulations. In his memo announcing the rescission, the Attorney General made it clear that U.S. Attorney Offices across the country possessed the full complement of federal authority and power to prosecute state-legal cannabis. Even at the MED, the shock of the rescission sent some employees into a panic. The event made January 4, 2018 a distinctly memorable day for all of us. Although the federal crackdown some feared never materialized, the wake of the memo’s rescission had negative outcomes on fundraising and the efforts to expand banking services for the industry.

Takeaway

The U.S. cannabis industry’s giant leap in the 2010s established a solid foundation, confirming that it is here to stay. As we enter the 2020s, we should pause to assess what lessons can be learned from the industry’s failures and near misses. The near miss of the Sweet Leaf case teaches that in order to comprehensively manage the risks posed to a cannabis business, even those that transcend compliance with cannabis-specific regulations, a new paradigm is necessary. Although cannabis operations may always require a heavy lift in compliance, implementing and maturing corporate risk management best practices will equip owners and operators with robust and tested tools to continue thriving throughout the next decade, regardless of the vague and evolving legal environment.

*Extended Plant Count (EPC) patients are recommended larger amounts than the 2 ounce and 6 plants medical norm in Colorado. Some Sweet Leaf loopers were recommended 99 plants and up to 35 ounces.

—

Copyright Copacetic Strategies LLC 2020

Philip DS Martin served as the Marijuana Enforcement Division’s Data Analysis Manager during the Sweet Leaf saga. Conducting sophisticated analyses on inventory tracking and point of sale data, his team aggregated and outlined Sweet Leaf’s operations and impact. He testified in Sweet Leaf’s license revocation hearing and was a sworn grand jury investigator in the criminal investigation that concluded with a plea bargain. Learn more about Phil’s experience and qualifications here.

Investigation

Given that the administrative and criminal prosecution of the case would hinge on the scope and aggregate impact of Sweet Leaf’s activities and business practices, the specialized Data Analysis Unit (DAU) at the Marijuana Enforcement Division (MED) became instrumentally involved. By the end of the grand jury investigation, the DAU had identified $10 million in medical marijuana that was sold to loopers, transaction by transaction, in just ten months. One EPC* looper spent more than $575,000 in the span of 137 days (¶ 120).

Scale and Patterns

The largest single-day looper by weight managed to purchase over thirty-eight pounds in nineteen transactions in two hours on April 20, 2017–the busiest day of the year for Colorado stores. At their retail locations, the purchase pattern of out-of-state customers purchasing one ounce of flower was overwhelming (¶ 121-122). Testifying in the city’s license revocation hearing, one Sweet Leaf manager estimated that between thirty and fifty percent of Sweet Leaf’s $60-80 million in sales were to loopers (¶ 91).

Reaction

The undertones of the industry’s reaction made it appear that the Sweet Leaf case was significant enough to become a catalyst for federal intervention. In September 2018 the U.S. Attorney for Colorado went on record stating that his office was investigating a state-licensed business, confirming everyone’s worst fears. In the end, the combined weight of city and state regulators, plus the specter of federal prosecution, was sufficient to compel the owners to accept a plea bargain that included one year prison sentences. Despite the owners of Sweet Leaf doing hard time, the industry narrowly avoided a potentially devastating federal organized crime case from being prosecuted against a celebrated state-licensed cannabis business.

Costs

The cost imposed on the industry was the rescission of the Cole Memo. Just three weeks after news about Sweet Leaf broke, then-Attorney General Jeff Sessions took the opportunity to rescind the memo that seemingly protected the industry from federal intervention provided businesses remained compliant with state licensing regulations. In his memo announcing the rescission, the Attorney General made it clear that U.S. Attorney Offices across the country possessed the full complement of federal authority and power to prosecute state-legal cannabis. Even at the MED, the shock of the rescission sent some employees into a panic. The event made January 4, 2018 a distinctly memorable day for all of us. Although the federal crackdown some feared never materialized, the wake of the memo’s rescission had negative outcomes on fundraising and the efforts to expand banking services for the industry.

Takeaway

The U.S. cannabis industry’s giant leap in the 2010s established a solid foundation, confirming that it is here to stay. As we enter the 2020s, we should pause to assess what lessons can be learned from the industry’s failures and near misses. The near miss of the Sweet Leaf case teaches that in order to comprehensively manage the risks posed to a cannabis business, even those that transcend compliance with cannabis-specific regulations, a new paradigm is necessary. Although cannabis operations may always require a heavy lift in compliance, implementing and maturing corporate risk management best practices will equip owners and operators with robust and tested tools to continue thriving throughout the next decade, regardless of the vague and evolving legal environment.

*Extended Plant Count (EPC) patients are recommended larger amounts than the 2 ounce and 6 plants medical norm in Colorado. Some Sweet Leaf loopers were recommended 99 plants and up to 35 ounces.

—

Copyright Copacetic Strategies LLC 2020

Philip DS Martin served as the Marijuana Enforcement Division’s Data Analysis Manager during the Sweet Leaf saga. Conducting sophisticated analyses on inventory tracking and point of sale data, his team aggregated and outlined Sweet Leaf’s operations and impact. He testified in Sweet Leaf’s license revocation hearing and was a sworn grand jury investigator in the criminal investigation that concluded with a plea bargain. Learn more about Phil’s experience and qualifications here.

Connect with Phil on LinkedIn or Leafwire.